There is a new and perhaps ironic class of incorrigible lawbreakers making headlines these days: federal judges. A recent Wall Street Journal investigation found that between 2010 and 2018, 131 federal judges “improperly” heard 685 court cases in which they or their family members owned shares of companies that were plaintiffs or defendants in their courtrooms. That’s nearly one-fifth of the roughly 700 federal judges whose records the newspaper reviewed.

Among the Journal’s findings: A New York district court judge presided over a case involving ExxonMobil and another company while he owned between $15,001 and $50,000 of Exxon stock. An Ohio-based appeals court judge wrote an opinion in favor of Ford Motor Company at the same time as her husband owned stock in Ford. In that case, the judge’s husband’s financial advisor bought more Ford stock for him after she heard arguments in the case, but before she issued her ruling.

The Journal was being too nice when it called the judges’ actions improper. The correct word is illegal. A 1974 law passed by Congress in the wake of the Watergate scandal set down a firm rule: Judges must disqualify themselves from any case in which they, their spouses, or their minor children own a “legal or equitable interest, however small.” The words of the statute could hardly be clearer.

The impartiality of the federal judiciary matters a great deal. Federal judges—currently, there are more than 800 of them—possess enormous, largely unchecked power. They can use it to award people millions of dollars in lawsuits, or throw those lawsuits out. They decide whether employees can recover for race or sex discrimination, whether megacorporations can be forced to pay for polluting the environment, and whether companies can cheat their retirees out of their pensions. And although the Journal exposé is certainly outrageous, it only scratches the surface: The real outrage here is how weak—how close to non-existent—the ethics rules for federal judges are in the first place.

That weakness begins with flaws in the existing law. The Journal reporters went to extraordinary lengths to uncover the 685 cases in which they identified judges with conflicts of interest. That is because although judges are required to make annual financial disclosures, their disclosures are not available online. Information about stock holdings are “cumbersome to request,” the Journal noted, “and sometimes take years to access.” Worse still, judges are notified when anyone requests to see their disclosures. That means that even the people with the strongest interest in rooting out potential conflicts of interest—the parties appearing before a judge—face a significant practical hurdle: No one wants to suggest that their judge may be ethically compromised and breaking the law.

The judges the Journal questioned about their conflicts were full of excuses: that they did not spot the conflict, or that their law clerks messed up. Julia Gibbons, an Ohio appeals-court judge, said that she had incorrectly believed she did not need to report stocks in her husband’s retirement account. It is hard to see how a federal statute that requires judges to recuse themselves if they or their spouse “have an interest that could be substantially affected by the outcome of the proceeding” is at all confusing on that point.

The larger problem is that judges and their spouses should not be holding stock in individual companies at all. A judge who holds stock in Ford is not ethically conflicted only in cases in which Ford is a party—that stake can influence how they see litigation over fuel mileage standards, product liability, and highway funding. A judge who invests in Amazon may be biased in cases that involve Wal-Mart, or criminal defendants accused of “porch piracy”—stealing packages delivered to people’s homes. When companies in their courtrooms put millions of dollars on the line, judges should not have direct financial interests in the success of any of them.

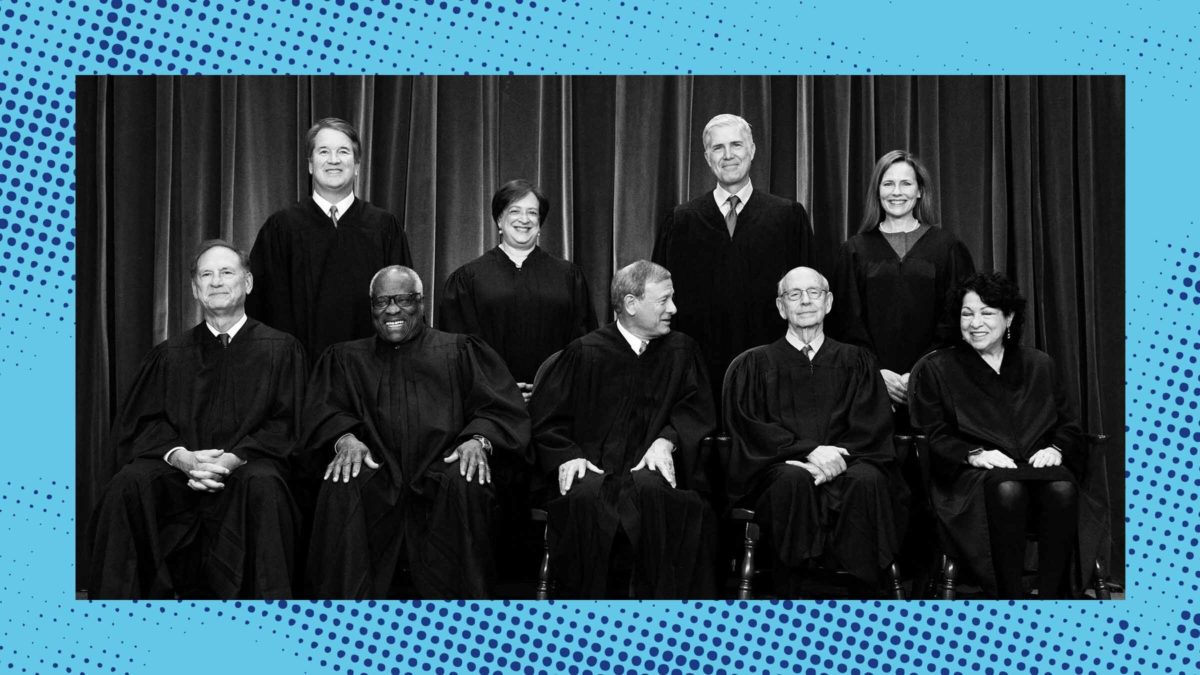

The Journal exposé did not include the most powerful federal judges of all—Supreme Court justices—for a simple reason: They cannot violate federal ethics laws, because no federal ethics laws apply to them. As a result, the Court is sort of an ethical free-for-all for justices across the ideological spectrum: Justice Clarence Thomas, for example, voted to strike down the Affordable Care Act after his wife was paid to lobby against the law. Justice Thomas neither recused himself nor explained why he did not. In 2015, Justice Stephen Breyer participated in a case even though his wife held stock in one of the companies involved in it; she sold the stock, worth about $33,000, after the publication of media reports on her ownership interest. No matter how significant their financial interest a party before them, whether a justice actually recuses from a given case depends largely on whether or not they feel like it.

When companies in their courtrooms put millions of dollars on the line, judges should not have direct financial interests in the success of any of them.

Reformers have tried to toughen judicial ethics laws already. The very first bill House Democrats introduced in 2019 was a government integrity law that would have required a binding Supreme Court ethics code. House Republicans and Senate Minority Leader Mitch McConnell, however, blocked these efforts. Chief Justice John Roberts has also run interference. In a year-end report on the federal judiciary in 2012, he insisted that there is “no reason to adopt the Code of Conduct as [the Court’s] definitive source of ethical guidance,” and vouched for the justices’ “exceptional integrity and experience.” Of course, if the justices are already behaving with exceptional integrity—and we can just agree to disagree on that—a reasonable code of ethics should not impose any significant burden on them.

More recently, in 2019, Justice Elena Kagan told a House committee that Roberts had been “studying the question” of instituting a Court-specific code of conduct, though it’s mostly been crickets since then. At the time, Justice Samuel Alito groused that he thought it was “inconsistent with the constitutional structure for lower court judges to be reviewing things done by Supreme Court justices for compliance with ethical rules.” There are many ways an ethics code for the Court could be structured—including, for example, enacting a law and leaving enforcement to the Senate’s impeachment power. It’s striking how someone as boldly activist as Alito in his conservative judicial rulings—on everything from deeply wounding labor unions to eviscerating protections against sex discrimination in pay—is a blubbering pile of incapacity when it comes to thinking of a way to ensure that Supreme Court justices are honest.

The solutions here aren’t complicated or controversial. At the very least, Congress could require judges’ financial holdings to be listed online in a searchable database, with an easy way for members of the public to report conflicts. A far stronger system would require judges to put their assets in a blind trust, as many elected officials already do. (Judges would still be free to invest in mutual funds, which existing ethics rules note do not create a vested interest in the health of any specific company.) A law that subjects Supreme Court justices to the same rules that govern their lower-court counterparts is long overdue. Democrats in Congress should be championing slam-dunk reforms like these, and leave Mitch McConnell and Senate Republicans to argue that this ongoing epidemic of conflicts of interest is even remotely consistent with the task of doing “justice.”

The public’s confidence in the Supreme Court—the federal court people are most familiar with—has been plummeting lately, to the lowest approval rating in decades. This comes at a time when income inequality is at near-record levels, and more than 80 percent of Americans say that large corporations have too much power. To date, the Supreme Court has chosen to respond to this self-inflicted crisis of confidence with a parade of justices—first Breyer, then Justice Amy Coney Barrett, then Thomas, then Alito—indignantly defending the Court’s integrity and high-mindedness.

The public’s growing disenchantment with a Court controlled by a 6-3 conservative supermajority is about far more than the precise composition of its members’ investment portfolios. But if the justices are at all serious about restoring some semblance of faith in the institution, embracing an ethics system with teeth would be a fine place to start.