The Supreme Court’s conservative supermajority just handed another big gift to their corporate cronies. On the heels of yesterday’s opinion making bribery even more legal in Snyder v. United States, the Court issued another ruling on ideological lines today, this time in Securities Exchange Commission v. Jarkesy. In a 6-3 decision, Chief Justice John Roberts held that the only constitutional way for the SEC to seek civil penalties for people who commit securities fraud is through jury trials, rather than through the agency’s administrative adjudicatory proceedings. What this means is that from now on, when people commit securities fraud, it will be a whole lot harder to hold them accountable for it.

This case started with a hedge fund manager and conservative talk radio host named George Jarkesy. Between 2007 and 2010, Jarkesy created two investment funds that managed roughly $24 million in assets for around 120 investors. As it turns out, in the name of charging higher fees, he lied to those investors about pretty much everything: who would audit the funds, who would be the funds’ broker, and how much the funds were worth. After an investigation, the SEC ordered him to give up nearly $685,000 in illicit gains and pay a $300,000 fine.

But Jarkesy argued that under the Seventh Amendment, which guarantees the “right of trial by jury” in civil matters where more than “twenty dollars” is at stake, the whole process was unconstitutional. And according to Roberts, an SEC enforcement action is basically the same thing as a run-of-the-mill lawsuit about just how “used” a used car you bought actually was. “The SEC’s antifraud provisions replicate common law fraud, and it is well established that common law claims must be heard by a jury,” he writes. “This is a common law suit in all but name. And such suits typically must be adjudicated in Article III courts.”

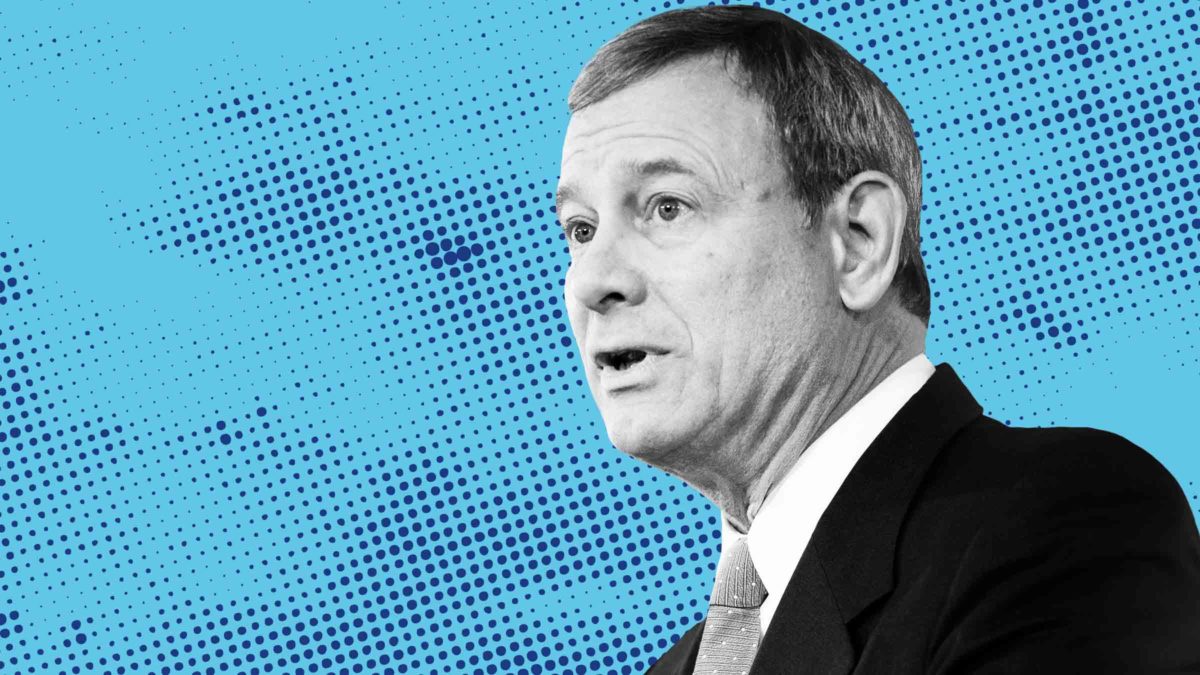

When a fraudster has to pay a fine (Photo by Brooks Kraft LLC/Corbis via Getty Images)

Don’t gloss over that word “typically.” There is an important exception: Almost fifty years ago, the Supreme Court unanimously ruled in a case called Atlas Roofing that Congress can create new statutory “public rights” and assign adjudication responsibilities to an administrative agency, like the SEC, without violating the Seventh Amendment. That’s exactly what happened here: After the Great Recession, Congress decided the existing common-law remedies weren’t enough to protect the public from financial catastrophe. Consistent with Atlas Roofing, it created a new statute, the Dodd-Frank Act, that protected the public’s right to fair and honest markets by providing for in-house enforcement of securities laws. “In a world where precedent means something, this should end the case,” wrote Justice Sonia Sotomayor in dissent. “Yet here it does not.”

Part of Sotomayor’s frustration stems from the fact that the majority didn’t really bother explaining why Atlas Roofing doesn’t apply. At one point, Roberts states that Jarkesy’s case “does not fall within any of the distinctive areas” implicated by the public rights exception, but expressly declines to delineate that boundary any further. (“The Court has not definitively explained the distinction between public and private rights, and we do not claim to do so today,” he writes.) Instead, the conservatives assert that applying Atlas Roofing would inappropriately extend the public rights exception’s scope (it’s not clear why), and suggest that they never liked Atlas Roofing anyway, describing it as “circular” and “a departure from our legal traditions” (it’s not clear how). This seems like a superficial way to dispose of a precedent that appears directly on point. But when you have a six-justice supermajority, there’s no real need to show your work.

Over the past several decades, Congress has enacted hundreds of statutes that empower dozens of agencies to impose civil penalties for violations thereof: laws that protect the environment, regulate workplace safety, empower workers to organize, establish product safety standards, and so on. Forcing enforcement proceedings out of agencies and into less-efficient, more-expensive, and conservative-captured courts will limit the agencies’ ability to actually fulfill their statutory mandates. The Court’s decision is a “massive sea change” in the law, as Sotomayor writes, and a “power grab” on the part of the justices. By curtailing agencies’ authority to enforce laws and regulations, the Court practically ensures those laws and regulations won’t be enforced by anyone.

In the majority opinion, Roberts and the conservatives extol the virtues of the jury trial, which, they say, they have a responsibility to protect with the “utmost care.” But Sotomayor cautions the public to “not mistake judicial hubris with the protection of individual rights.” Yet again, the Court is co-opting Congress’s policymaking authority. Yet again, the Court is blocking the executive branch from making wealthy crooks pay the piper. Yet again, the Court is acting as if it alone gets to decide what rights the public has, and what, if anything, the government can do to enforce and protect those rights. “This Court’s precedents and our coequal branches of Government deserve better,” Sotomayor writes. The public deserves better, too.